How AI Can Drive Productivity and Value In The Financial Sector?

08 Jul, 2024

7 min read

08 Jul, 2024

7 min read

Table of Content

Today, artificial intelligence is the most preferred and valued tool for enterprises because of its capacity to improve organizational efficiency and productivity. The financial industry has begun integrating AI software development services into its operations and services. This leads to improved customer relations and enhanced efficiency in businesses’ operations.

Generative AI is expected to have a large effect on the financial sector. McKinsey estimates that it could contribute $2.6 trillion. undefined Annual investment reached $4.4 trillion, with banking seen as one of the primary benefactors. For the banking industry, generative AI may automatically deal with up to 70% of business processes.

A survey conducted by NVIDIA indicated that there are still improving trends in adopting artificial intelligence in financial services. Over 400 experts observed the increasing significance of AI in 2024. Some of the areas where the technology finds many applications include risk management, customer service management, and the identification of fraudsters.

In this blog, you will learn about the primary uses of artificial intelligence and finance and how it is transforming banking services by providing exceptional customer service.

AI in financial services is revolutionizing the industry by making data-driven choices. This is instrumental in helping banks identify fraud incidences by identifying odd movements within transactions. It can also help with administrative work, including customer service, where chatbots can answer simple queries quickly.

Investment firms use AI to evaluate market flows for enhanced investment decisions. Apps designed for handling one’s personal finances use artificial intelligence to personalize recommendations according to users’ behavior.

AI increases the efficiency of risk management in finance, as it accurately predicts potential risks. AI enhances credit scoring since the loan application assessment is done more efficiently and objectively.

Overall, AI in financial services improves productivity, reduces risks, and enhances customers’ experiences.

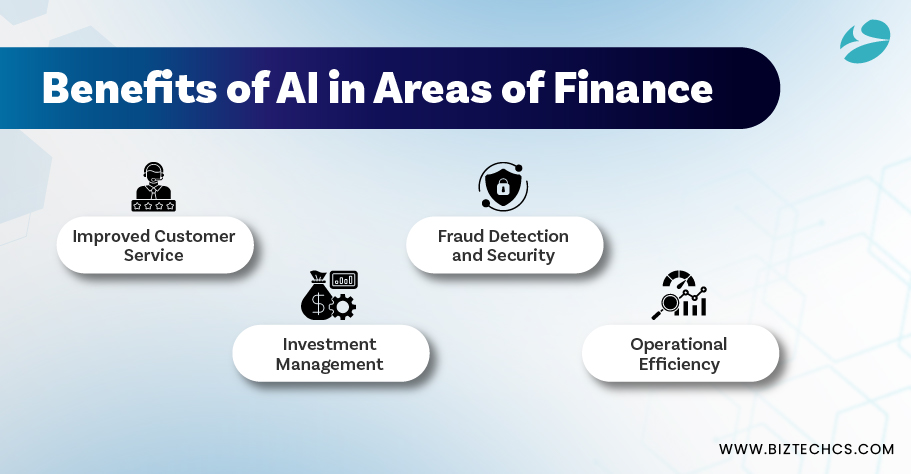

Artificial intelligence and finance enhance customer experience in the finance industry by offering prompt and correct answers to any question posed by customers at any time. This helps avoid customers getting stuck for hours waiting for the support team, improving the customer experience.

AI-supported chatbots and virtual agents can address regular questions to provide prompt service, while human agents can attend to complicated problems. This results in improved service delivery and better customer feedback.

Besides, it can diagnose customer issues and responses, look for common issues, and improve services, constantly making the process more effective and efficient.

AI in financial services is particularly useful because it increases the ability to detect and prevent fraud by identifying the corresponding anomalous trends and behaviors.

It can process the many transactions that happen in the banking sector in real-time, enabling banks to counter threats as they emerge. This also minimizes instances of fraud not being detected and safeguards customers’ financial wealth.

Further, AI utilized for fraud detection can learn from fraudsters’ methods and update them, enhancing its functionality. This preventive measure not only saves costs but also helps establish confidence among customers that the financial system is secure.

Investment management benefits significantly in applying AI in finance because it leads to better and faster decision-making.

AI can handle large amounts of data and can assess it, choosing the proper investment and making more effectual and profitable investments.

Further, risk management is easier through AI since it can predict certain risks, such as market risk, and recommend actions. To summarise, AI augments the efficiency and profitability of investment management.

Artificial intelligence and finance also enable efficiency in the finance field, as it reduces human workload and improves operational procedures.

AI systems can process large amounts of information, enhancing the speed of decision-making and reducing the possibility of mistakes generated by manual data processing. The application of automation means that financial institutions can process more transactions and services without necessarily having to hire other employees.

Also, lesser error rates mean better security as well as reliability in things like fraud mitigation and risk analysis. All in all, these enhancements create efficiency within the overall cost for the monetary sector and boost its productivity.

The integration of AI in financial services poses a problem of safeguarding data in the financial sector.

Banks and other financial institutions possess sensitive information about account holders, their transactions, and other basic details that must not be exposed to anyone outside the authorized individuals.

AI systems rely on datasets to deliver their best performance, meaning that data could be exposed. If we add the extra consideration of working in compliance with strict laws like GDPR or the CCPA, then the above becomes even more challenging.

Also, there are issues where cyber-attacks can affect AI algorithms and even alter financial data for fraudulent purposes and lead to loss of funds.

As a result, information protection has to be heightened considerably to incorporate AI safely into the financial industry.

The main threat to applying artificial intelligence in the finance sector is the high implementation costs. To create an AI system, a significant amount of resources, technology, professional expertise, and infrastructure must be devoted to it.

Sometimes, the infrastructure can also be relatively costly, especially in the early stages of the application when hardware and software must be bought. Consequently, the costs associated with ongoing maintenance, upkeep, and upgrade of AI systems, as well as providing staff training on how to use AI properly and efficiently, contribute to the expenses.

It is especially challenging for small players within the financial industry to justify these costs, and hence, the rate of adoption will be relatively slow.

Hence, the overall impact may not be as great because the high costs of adoption may pose a problem, restricting the total amount of benefit that AI could confer on the whole sector.

AAI in financial services involves key ethical concerns, mainly on data protection and prejudice.

AI systems depend on extensive databases of personal and financial data, which raises questions about how these data are collected, stored, and used.

Another concern is that AI algorithms are pre-programmed and, therefore, may learn prejudice from the data given to them and discriminate against certain people.

Furthermore, AI transactions entail less disclosure about the major decisions made in order to guide clients in making the right financial decisions. This opaqueness can further reduce the level of confidence and invite legal and regulatory problems.

Finally, there is the issue of making AI systems resistant to fraud and deceitful practices, which is very important, especially in the financial industry.

Another problem that can be discovered when applying artificial intelligence and finance is the technological constraints of existing systems.

Most firms in the financial sector continue to use substandard software and hardware that is incompatible with modern AI systems.

These limitations cause problems with the processing speed, accuracy, and security of the data to be processed. Thirdly, due to the intricacy of financial regulations, AI systems must be flexible, which may be a problem with legacy systems.

Consequently, we find that financial firms may incur large costs and long implementation times to integrate new systems that take advantage of all AI features.

AI models in corporate finance manage to analyze previous information and trends, helping firms manage their budgets and forecast their financial future.

These models help to predict future revenues, future expenses, and future profitability based on past results.

Further, through the use of AI, one can choose some hypothetical conditions, such as recession or economic growth, and compare their impact on a company’s financial condition. This is important in assisting businesses in anticipating several possibilities and ensuring that risks are well controlled.

By using predictive analytics and scenario analysis, economic decisions can be made to improve the firm’s financial position.

In corporate finance, AI is critical in natural language processing, which can help extract data from different sources and summarize how reports are generated.

This automation aids the finance teams to work more on the analysis rather than gathering the data. AI also helps companies adhere to financial regulation by automating the audit process, making it faster and more precise.

It detects discrepancies in financial statements, which minimizes the chances of human errors that would lead to legal complications.

Thus, the use of these AI tools can also help companies to stay financially credible while also simplifying their reporting.

In corporate finance, AI is used in algorithmic trading, where algorithms use market data to make high-frequency trading decisions in an effort to provide the best returns.

These algorithms are capable of analyzing large volumes of information and performing trades in the blink of an eye, thus eliminating the chance of missing an opportunity.

Finally, AI models help rebalance by analyzing risks and returns on different assets to suggest suitable portfolios.

This is good news for companies as they can invest in well-balanced portfolios that fit their financial objectives and risk capacity. Thus, by adopting AI in these ways, businesses make better investment decisions, hence improving their overall performance.

Artificial intelligence is essential in corporate finance, especially in Mergers and acquisitions (M&A) and company evaluation models.

The presence of AI ensures that firms can explore the market, find suitable acquisition targets, and enter the deal as needed due to analyzed market trends and financial data.

Also, AI leads to better accuracy in the company valuation since it takes more factors and real-time information into account that may be overlooked in traditional models. This makes the valuations more accurate and depicts the actual value of a firm within the contemporary market.

As a result, managing decisions are more strategic, and operational risks and growth opportunities can be minimized.

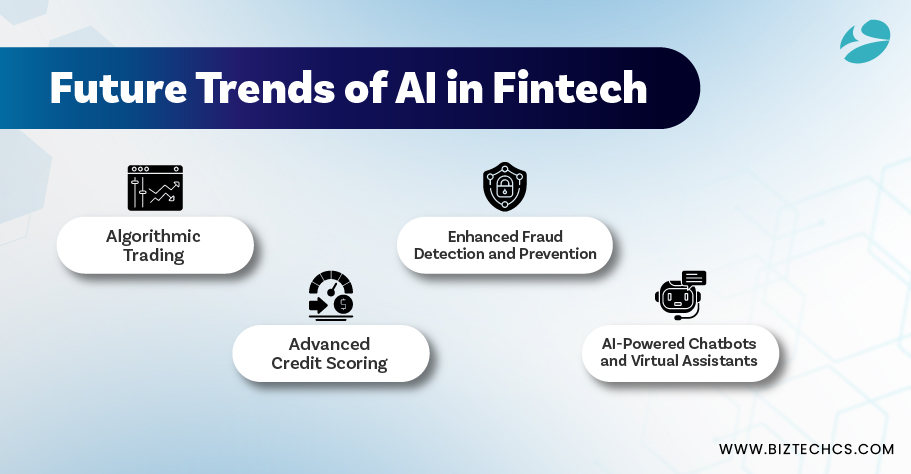

Algorithmic trading, which uses artificial intelligence to make superior, faster, and more efficient trades, is expected to reshape the fintech industry.

In the future, AI in financial services will use big data to analyze the market in real time and find patterns and opportunities that are not noticeable to a human. Thus, it will ensure more accurate and profitable trades while minimizing impulse reactions that often precede wrong decisions.

Additionally, AI will adapt to market changes quicker, making real-time adjustments to trading strategies to optimize outcomes.

In conclusion, the application of AI in the algorithmic trading of financial instruments is likely to increase the effectiveness and profitability of financial markets while changing the nature of investment and trading.

Fraud detection and prevention will be a prominent area where artificial intelligence in fintech will emphasize increasing the efficiency of security measures.

A lot of transaction data will be fed into the AI algorithms in real time, and the AI systems will sift through it and look for trends indicative of fraudulent activity.

These systems will build upon the results of each interaction and minimize false positives over the number of interactions.

Further, it will enable faster intervention in fraudulent cases and reduce losses while improving user confidence.

As fintech progresses further, AI-based anti-fraud measures will remain the norm, able to reliably and accurately protect the financial world.

Advanced credit scoring using Artificial Intelligence has become more popular in the financial technology industry.

Machine learning algorithms work with higher amounts of data, including non-conventional methods such as social media and behavioral analysis, to better understand credit risk. It enables lenders to extend credit to customers who cannot give standard credit references and records.

It also minimizes the likelihood of default since any problems that may occur are easy to point out. Therefore, advanced credit scoring allows borrowing money to be more achievable and even more equitable, making it a revolutionary concept in the financial industry.

AI Chatbots and Virtual Assistants are being implemented to enhance customer relations and the general flow of financial operations in the Fintech sector.

These tools respond to customer inquiries instantly and enable users to handle their financial issues effectively.

They also support checking account balances, funds transfers, and other financial consultations via conversational systems. This trend reduces the need for human intervention, lowering operational costs for fintech firms while enhancing the customer experience.

In summary, adopting AI chatbots and virtual assistants in fintech enhances the ease of access to financial services.

In conclusion, productivity and value creation are rising in the financial industry with the adoption of AI.

Automating repetitive tasks allows financial institutions to reduce the time required for those tasks and the associated expenses. AI solutions augment advanced analysis and help make better decisions and manage risks.

AI-driven personalized advice increases customer satisfaction and loyalty levels on financial products. Also, it is used for predictive processes such as market analysis and opportunities for investment.

In sum, adopting artificial intelligence and finance is innovating the industry and achieving higher customer satisfaction and futuristic solutions.

AI is used in the stock market to feed traders the right information and manage extremely large data over a short time. It can make predictions about future stock trends, find opportunities for trading, and execute these trades within the shortest time possible. This makes it easier and can ultimately lead to a rise in revenues or just the bottom line.

AI plays a significant role in finance because of the large data volumes and its accurate predictive analytics capability. It facilitates decision-making processes, is cost-effective, and also helps enhance overall customer relations. Financial institutions must implement AI to remain competitive and satisfy customer needs.

AI aids in fraud prevention by analyzing activities such as transactions and recognizing anomalies. It can easily identify such behaviors and report them to law enforcement agents. This assists in combating fraud and safeguarding customers’ funds.

AI can assist in personal finance since it can offer customized recommendations and track expenses. It can monitor expenditure, recommend saving money, and pay bills on your behalf. This makes managing money easier and much more effective.

Artificial Intelligence (AI)

130

By Devik Gondaliya

22 Apr, 2025

Storyblok

33866

By Devik Gondaliya

02 Apr, 2025

Storyblok

34822

By Devik Gondaliya

01 Apr, 2025