How AI Flagging System is Used for Fraud Detection?

22 Apr, 2025

10 min read

22 Apr, 2025

10 min read

Table Of Content

Sometimes, a small and unusual transaction can ring massive alarm bells in a much bigger fraudulent scheme. It is almost impossible to detect such fraud patterns manually, which is why, over time, more and more companies are turning to AI flagging systems. These systems scan thousands of transactions in seconds and alert when something appears suspicious.

According to a report published by Statista in 2023, over 50% of global enterprises utilize AI tools for fraud detection. This means that CFOs and other top executives will have faster decisions based on real-time insights.

Financial Fraud Detection provides much more than audits and manual review. Indeed, AI-powered fraud prevention adds another layer of security without slowing down business operations. Many organizations now partner with firms offering AI/ML development services to create tailored fraud detection models that adapt to evolving threats, ensuring both agility and protection in today’s fast-moving financial landscape.

Fraud detection is much more than detecting simple mistakes. Fraud actions can sometimes be so subtle that they are integrated into genuine activities. The traditional systems may miss this, leading to false negatives.

AI in fraud identification has made significant strides in recognizing these patterns, but its true merit remains heavily dependent on the system’s training.

Lacking context or accurate data, even the most sophisticated systems may flag inappropriate items or miss genuine threats.

Doing manual fraud checks and document verifications can take hours or even days sometimes. It creates a bottleneck in processes, ultimately hampering the customer experience. People spend time doing activities that should have been automated.

AI workflow automation can eliminate such busy work, but it is not uniformly applied across industries. The challenge is to reliably review indicators for suspicious activity within a manageable timeframe.

The grammatically sound intelligent system is of no use if it can not be conveniently used by the teams. Many tools for fraud detection are too complicated and do not work well with existing platforms—poor integration results in slowdowns or gaps in monitoring.

The AI for document verification should integrate seamlessly with internal tools. However, it may also result in the failure of even a mighty system in its daily use.

The same thing can be said for the number of transactions and documents an expanding firm generates. A system that performs for 100 users will, however, not work efficiently for 10,000 users.

Indeed, scalability presents a true dilemma when fraud systems are virtually unscalable by design. AI tools must sustain performance while scaling with the business. When right, it supports growth without the risk it generates.

Moreover, the delicate handling of sensitive data entails huge responsibilities. Secure data processing is prime in both building customer trust and legal compliance. Even so, some systems still lack all the safeguards necessary to be fully compliant.

Hence, they open the doors to legal and financial risks. Both protection and performance are always compromised in this struggle.

An AI-fraud detection system works by analyzing real-time data over larger ranges. It analyzes data to identify unusual patterns indicative of fraud, such as sudden changes in user behavior or discrepancies in document details.

These systems utilize historical data to understand what constitutes “normal,” identifying specific flags for items that deviate from this norm. One major advantage is that it tends to learn and improve with time.

Tampering detection is one of the important features for identifying false and altered documents during onboarding or transactions. Coupled with intelligent document processing, the system can read, verify, and analyze files without requiring manual checks.

Together with the fraud-savvy AI, this creates a very robust and agile fraud detection system, acting under the hood where frauds are not easily hidden but much harder to detect and stop.

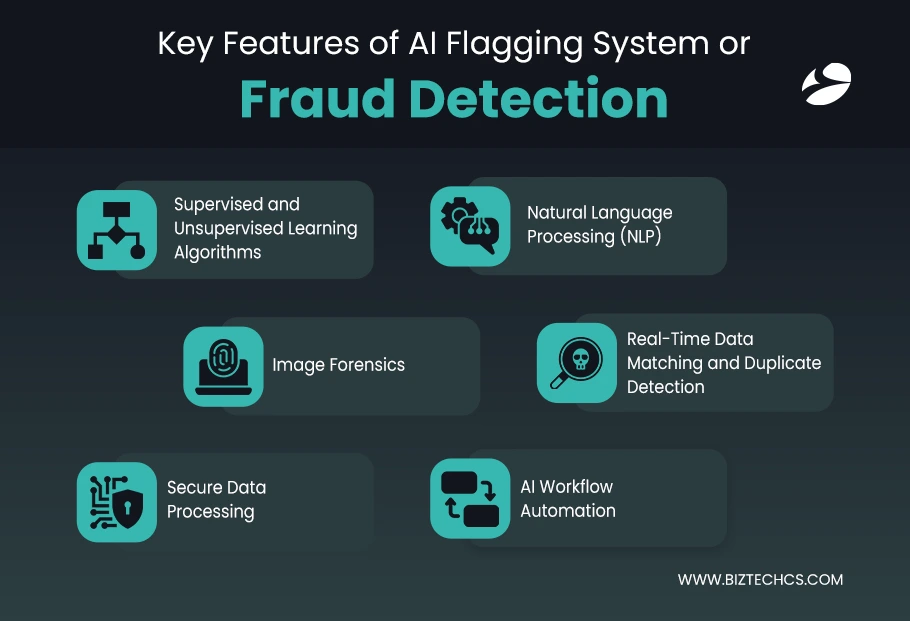

These algorithms enable the fraud detection system to learn from both known and unknown patterns. They track external state changes and variations in past examples to aid in supervised recognition, enabling the detection of fraud.

Moreover, a new type of fraud is identified through unsupervised learning, which detects unusual behavior. This state provides a wide range of adaptability to changing risks and strengthens AI for fraud detection, as it covers both known and unknown threats.

Natural language processing will decipher the text entered by a user or a document that has been scanned. It will help check for false claims, mismatches of information, or conflicting statements, and flag suspicious language commonly used in fraudulent communications.

With this improvement, the detection process will be exhaustive and precise. NLP thereby enhances the system’s ability to understand human language in fraud detection.

Image forensics involves verifying whether changes have been made to digital visual documents. It advocates for document tampering detection, as it assesses file details that are usually out of sight from the human eye.

It primarily examines metadata, image layers, and even resolution inconsistencies. It comes in handy for validating ID cards or even photos of scanned forms. It adds a layer of security against document verification.

It compares the new information with the stored information already in the system and captures entries that are either too similar or identical. In this way, real-time matching prevents the same fraud scheme from being applied repeatedly.

This ensures the accuracy of the system and prevents duplicates. Very important for maintaining the sharpness and efficiency of the fraud detection system.

Every stage in fraud detection involves handling sensitive data; that’s why secure data processing is built into the system from the ground up, ensuring personal and financial data remain secure during analysis.

Strong security also ensures legal compliance, thereby providing confidence in the system’s approach to managing information.

An artificial intelligence workflow automation system will enable tasks to be moved around the system without delay, controlling processes such as flagging, reviewing, or sorting data repeatedly, thereby speeding up the pace without compromising accuracy.

Intelligent document processing is beautifully added to reduce manual checks. It keeps the plunge detection system swift, organized, and dependable.

LangChain and LangGraph serve to build the logic of the AI framework. The interpretation they provide in the logic of the system enables handling multiple steps in a sequence and decision-making based on the flow of data. This would ideally relate well to the optimum control of the fraud detection system regarding its response through different inputs.This makes it more flexible to update models and workflows—an endorsement of a great foundation for building AI systems, both flexible and stable.

Such is the proficiency of Azure OpenAI in providing AI capabilities, which could possibly enable the understanding or analysis of complex data and, eventually, in performing language comprehension, pattern recognition, and behavioral analysis.Cloud setup depends on speed, scalability, and secure. Therefore, Azure OpenAI enables a highly reliable detection of document tampering, enhancing smarter workflows without compromising efficiency in the fraud detection system.

Scikit-learn, TensorFlow, and PyTorch libraries help train and run artificial intelligence models. Using these models, users will identify specific patterns related to their financial behavior, document uploading, or transactional logs.They form the main engine of artificial intelligence in fraud detection by enabling it to learn from past and new data. These libraries can be used to continuously improve models continuously, ensuring the system remains accurate as fraud methods become increasingly sophisticated.

Databases will form part of the infrastructure, which will be reliable in storing all inputs, processed results, and decisions made by the system. Fast access to this data is essential for real-time fraud checks. Security by design allows automated, intelligent document processing without compromising user security.Infrastructure elements are backups, monitoring, and load balancing. All this ensures that the fraud detection system operates very smoothly, even when the volumes are high.

The AI flagging system relies on a multi-agent architecture, where each agent is assigned an individual task. This multi-agent architecture allows dividing the entire process of fraud detection into small, manageable units. Each agent performs its own work and then passes the results to the next in line. Speed and accuracy will be improved all over the system.

From reading files to analyzing content and matching patterns, every step is automated. Due to this layered approach, the fraud detection system is also more reliable and easier to maintain.

A data ingestion agent collects data from forms, files, APIs, or databases, checks the format, filters out noise, and prepares the input for processing. This assures that whatever enters the system is clean and structured. It is also capable of supporting various types of content, including texts, images, and PDFs. With a solid grasp of the basics, it promises better performance down the line. It maintains the entire fraud detection system’s consistency.

This agent reads text from scanned documents and images, converting unstructured visual data to machine-readable content. It is imperative in cases involving IDs, receipts, or handwritten forms.

The output is then transferred to intelligent document processing for further scrutiny. Precision is essential at this point, as even a slight inaccuracy can affect the rest of the process. The OCR agent helps connect the physical document world to the digital world of review.

The NLP agent assesses the extracted text for any signs of falsehood or suspiciousness. Selection of words, tone, and internal consistency within the document is scrutinized. This is a help for spotting errors that may not spring to the eye at first sight.

AI powers fraud detection by extracting meaningful insights from mere text. The agent works more efficiently when volumes are high, accelerating activities that otherwise would take humans far longer. It also interfaces more seamlessly with the other agents to enhance the smooth transition of work.

Check this agent out for visual clues of image alteration or modification. It assists in detecting document tampering through pixel, layer, and metadata analysis. Whether it’s signature forgery or image blurring to conceal something, the agent raises flags for each anomaly.

It works on ID cards, certificates, and any other document with some visual content. Even the minor changes are flagged for further scrutiny. The image forensics agent lends strength to the visual perspective of fraud detection.

This agent matches current data events with historical events to identify duplicates or anomalies. It tracks repeated submissions, unusual behavioral patterns, and values that seem somewhat unexpected. Anything that does not seem right gets flagged for review. This agent operates quickly and in real-time to thwart ongoing fraud efforts.

It uses its findings to add learning into the system for future use. It also serves as an additional layer of defense within the fraud detection system’s workflow.

After all the other agents finish their job, this one collates the results. It generates an aggregated risk score based on the results of all agents. A higher score indicates a riskier situation, which can trigger alerts or actions.

This step helps make the fraud detection system more focused and easy to review. It reduces false positives by weighing all evidence and consideration before raising a flag. This agent ensures the final output is crystal clear, correct, and ready for decision-making.

It is the act of a user submitting data, such as forms, documents, or images, to the system. The system checks the file type, format, and structure. Clean and organized input is then passed to the next step.

This stage sets the base for everything else in the fraud detection system to perform correctly. For example, all future analyses would start from this point using reliable data.

Ingested data will enable the simultaneous operation of different agents. Scanning text, checking images, and analyzing patterns can all coincide. In this case, performance is boosted without sacrificing speed. It supports intelligent document processing by allowing each part of the file to be reviewed independently. Fast but thorough in detecting any sign of fraud.

At this stage, the system compares new information and existing records. It will look for entries that occur more than once or exhibit unusual behavior. Even a small variation may indicate evidence of fraud.

AI in fraud detection will help provide those pattern recognitions, which don’t match expected activities. This step ensures that the system remains aware and learns from new cases.

The system scores the submission using the risk criteria at the end of all checks. High-risk cases get flagged and are displayed on a secure dashboard. Teams gain access to view, sort through, and act upon cases with one another.

Evidence like document tampering detection helps make it easier to trust the system’s judgment. The dashboard keeps the fraud detection system clear, focused, and ready for review.

Some decisions remain subjective, even with extensive automation. There are gray areas where the system flags cases but would require human interpretation. One can imagine a reviewer sitting down, looking at flagged results, and deciding whether fraud is likely.

This process reduces false positives and improves the accuracy of the whole fraud detection system over time. This also helps build and refine future AI development for fraud detection, as it provides real-world outcomes for future learning.

Human-in-the-loop ensures that no critical case is processed without oversight. Control, trust, and balance are added to highly automated processes.

It is the AI flagging system that will conveniently take over the fast tiring and laborious 99 percent of checks that the repetitive work always requires. Running entries through the suspects into a case for long hours, scanning documents, verifying all the given details, and reviewing entries will simply be automated.

It is all made complex by the need to address essential disputes and resolutions with speed. Reduced fatigue will gradually and considerably influence human error. Intelligent document processing will ensure very smooth and more reliable operations.

The system processes large amounts of data in seconds and presents precise results for faster action without second-guessing. An accelerated approval process and quicker responses to fraud would enhance service flow. The real-time insights offered by AI in fraud detection significantly contribute to more confident and responsive decisions.

The system uses the same set of rules and checks repeatedly. This minimizes the chances of wrongfully dismissing actual fraud or flagging genuine actions. It also ensures that all reviews are conducted on a uniform basis, thereby increasing fairness.

It features additional reliable security measures, including document tampering detection. All these ensure that the efficiency of checks is improved without slowing down the fraud detection system.

The system provides a scoring framework based on different risk elements. Entries deemed high risk are flagged instantly for further review. It helps in the efficient targeting of frailty efforts where it matters. Low-risk cases are expedited; hence, delays are removed. The fraud detection system identifies areas of weakness that enable more targeted monitoring.

The system records everything it ever did. This allows for transparent audit and compliance checks. Teams get to demonstrate exactly how and why a decision was made. This level of transparency helps build trustworthiness and accountability into the system. Regulation is met, with document tampering detection and smart tracking aids.

Healthcare systems are more susceptible to fraud scenarios involving false claims, duplicate billing, and fake patient records. AI in fraud detection can recognize unusual patterns in billing or service usage.

AI can utilize intelligent document processing to reveal deceptions where there was a non-congruence between treatment records and the submitted diagnoses.

The National Health Care Anti-Fraud Association (NHCAA) reports that healthcare fraud costs the United States approximately $68 billion annually. AI tools decrease manual reviews while enhancing accuracy throughout the claims process.

Industries commonly referred to as banking and financial fraud encompass fraudulent transactions, identity theft, and document forgery. AI helps banks and financial institutions catch these in real-time by learning from past cases of fraud.

It can flag tampered forms by document tampering detection and quickly notify risk teams. It is further stated that AI has helped financial institutions mitigate fraud losses by approximately 25%. Making the fraud detection a responsive approach and cost-efficient as well.

Fraud prevention in government services often involves false claims and identity documents, along with duplicate applications. AI systems filter applications and flag irregularities and verify the documents within seconds, allowing real-time monitoring and trust building in social and identity programs.

An estimated $36 billion in improper payments were made during the pandemic in unemployment benefits, according to a 2022 U.S. Department of Labor Report.

Such breaches and coping from already existing checks will allow AI tools of AI make these systems more secure and efficient.

Our solution offers precise fraud detection. The approach is highly layered, with each data type—text, image, and behavior—having a dedicated module for its review.

The system does not send alerts unless there is an apparent reason to do so. It also develops on its own through feedback to achieve better results over time.

Fraud detection seems to be a particularly apt application for AI, as it helps balance the volume of alerts with relative risk, and our solution does that quite well. The aim is to catch actual frauds but keep all the run-of-the-mill events moving quickly through the system.

Speed is crucial in reviewing a large number of submissions. Our system will perform document checking, pattern analysis, and risk scoring within seconds. Parallel processing allows multiple tasks to be executed simultaneously, without any waiting time.

This enables faster human processing by allowing for earlier identification of fraud. Slow manual reviews are a thing of the past, now that intelligent document processing has arrived. This translates into faster but reliable decisions.

A System becomes effective only if it is used efficiently by people. We designed the interface to be clean, clear, and simple enough to follow. All flagged entries come together with the reasons and scores, making teams to focus.

Even when findings are complex, they show in a way that makes sense. The dashboard highlights visual workflows. It supports the fraud detection system without adding confusion or extra training time.

The solution works just as well with 500 records as it does with 5 million. It would be able to manage growth without slowing down or crashing under pressure. Architecture allows for the adding of new modules or types of data when required.

Whether your needs grow quickly or gradually, the system adapts itself without changes to the core design. This makes it easy and low-risk to scale. This flexibility is needed for any fraud detection system to stay relevant.

Security is incorporated into every layer of our system. Data during upload, processing, and storing is encrypted. All the compliance requirements across the various industries are met.

There are user access controls, logs, and privacy filters, which are extremely necessary, while features such as document tampering detection are also functional. We ensure that by holding perfect safety, trust is never compromised.

Detecting fraud using manual methods alone is becoming increasingly complex. This is why an ingenious and scalable system is needed to stay ahead. Our AI flagging solution brings speed, clarity, and consistency to every node of the review process, from real-time pattern checks to document tampering detection, enabling you to pinpoint fraudulent activity with confidence.

Through intelligent document processing, complex documents can be reviewed more quickly and accurately. This is an adaptive, continually learning fraud detection system that maintains strong and steady performance. As seen with innovations like AI in healthcare, combining deep learning with domain-specific knowledge leads to more robust and trustworthy outcomes.

It combines human insight and automation to provide a resilient and secure path in fraud control.

Storyblok

34242

By Devik Gondaliya

02 Apr, 2025

Storyblok

35179

By Devik Gondaliya

01 Apr, 2025

Storyblok

35722

By Devik Gondaliya

27 Mar, 2025